It is generally believed that by incorporating ESG factors into investment decisions and management processes, asset management companies can reduce financial losses or reputational impacts when facing environmental and social risks, thereby enhancing operational resilience. In recent years, as global governments and regulatory agencies have actively guided capital towards ESG-related projects, more institutional investors are demanding that their funds be invested in projects that align with sustainable development goals, pursuing long-term value and stable returns. Therefore, ESG is no longer merely a representation of philanthropy and social responsibility but has become a crucial component of corporate operations and investment decision-making.

Diamond Biofund focuses on the biotechnology and healthcare investment sector, targeting competitive biotech startups involved in new drug development, advanced medical devices, innovative medical services, medical distribution, and agricultural biotechnology. This year, in addition to disclosing our company's environmental information, we also included important environmental-related information for five of our portfolio companies: Cho Pharma, Inc., Oneness Biotech Co., Ltd., Sinew Pharma Inc., StemCyte Taiwan Co., Ltd., and Tetanti AgriBiotech Inc. As of December 31, 2023, the total book value (i.e., fair value) of these five portfolio companies accounted for 77.02% of Diamond Biofund's total book value of "financial assets measured at fair value through profit or loss—current and non-current." When including "Diamond Biofund I Inc." and "Diamond Biofund II Inc.," this proportion reaches 95.58%.

To meet regulatory requirements and stakeholders' expectations for information transparency, the company adopts the framework of the Task Force on Climate-related Financial Disclosures (TCFD) issued by the Financial Stability Board (FSB), disclosing governance, strategy, risk management, and metrics and targets.

Governance

The Board of Directors has approved the "Sustainable Development Practices Guidelines" and the "Sustainability Information Management Guidelines." To enhance the effectiveness of sustainability management, the "Sustainable Development and Nominating Committee," a functional committee chaired by an independent director, is tasked with supervising sustainable development and sustainability information management activities.

Additionally, Diamond Biofund has formed the " Sustainable Development and Risk Management Task Force," led by the President’s Office and overseen by the President. The Task Force is responsible for planning, promoting, consolidating, and reviewing matters related to sustainable development and sustainability information. Under the " Sustainable Development and Risk Management Task Force," three functional subgroups/teams are set up: "Corporate Governance," "Social Participation," and "Sustainable Finance," with each department joining the respective group according to their business and responsibilities. The "Sustainable Development and Risk Management Task Force" shall report to the "Sustainable Development and Nominating Committee" and the board of directors at least twice a year regarding management and operations. The "Sustainable Development and Risk Management Task Force" shall also require each department to formulate corresponding management and control methods to improve risk control and ensure the achievement of the sustainable operation goal.

The Sustainable Finance Team oversees the climate-related governance, and is responsible for conducting the GHG inventory for the Company and its investment targets. The GHG inventory is presented by the "Sustainable Development and Risk Management Task Force" to the "Sustainable Development and Nominating Committee" and the Board of Directors.

Strategy

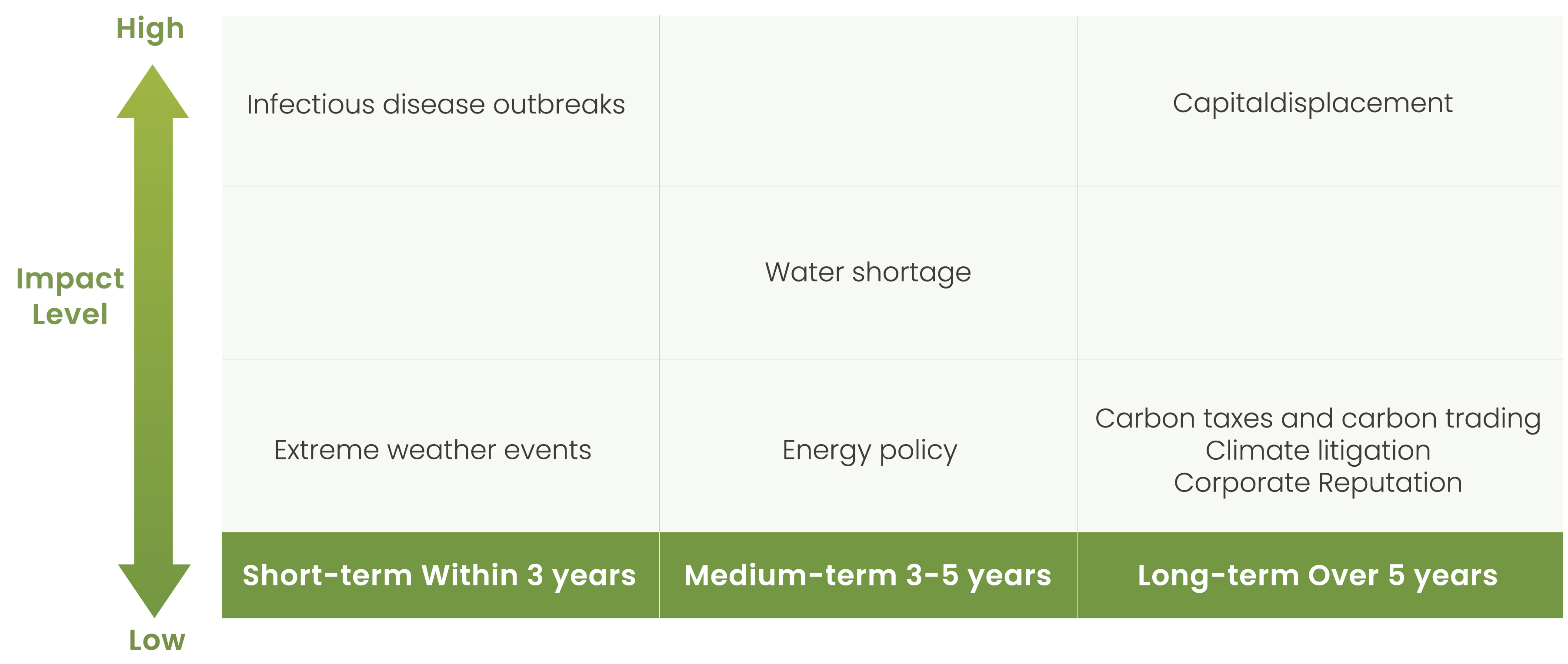

Diamond Biofund conducts climate risk workshops with participation from specialized personnel and senior managers from various departments. Climate risk questionnaires are distributed to portfolio companies to analyze the short, medium, and long-term physical and transitional risks that Diamond Biofund may face, as well as related business opportunities. This helps to further develop mitigation and adaptation strategies, enhancing the company's climate resilience.

To enhance climate resilience, in addition to reducing risks, the workshop also identified potential development opportunities in response to climate change.

|

|

Opportunity Factor |

Description of Opportunity |

Response Strategy |

|

Climate Mitigation Opportunities |

Reducing carbon emissions |

Portfolio companies with carbon reduction benefits |

Diamond Biofund's investment in Tetanti AgriBiotech Inc., specializing in organic waste treatment with "targeted enzymes," significantly improves composting efficiency, presenting potential opportunities to reduce carbon emissions in addition to enhancing resource recycling efficiency. |

|

Climate Adaptation Opportunities |

Enhancing climate resilience |

Developing portfolio companies’ ability to cope with climate change |

Strengthen employees' environmental protection knowledge and provide training and comprehensive post-investment management to portfolio companies, proactively identifying climate risks and opportunities. |

|

Improving human health |

Climate change impacts public health, increasing market demand |

Allocate resources to research and development in areas with potential markets and indications, addressing environmental and social issues while creating company value. |

Risk Management

To strengthen corporate governance and establish effective risk management mechanisms, the company assesses and monitors risk tolerance and management. In 2022, the Board of Directors approved the "Risk Management Policy and Procedures" as the company's highest guiding principles for risk management. The company integrates and manages various potential risks that could affect operations and profitability, implementing early warning measures and appropriate preventive actions to maintain operational activities in case of incidents.

The responsible units identify relevant risk factors, measure and analyze the potential impacts of various risks on operations, and develop risk control measures to keep risks within manageable and controllable levels. The risk team regularly reports to the Audit Committee, which supervises the company's and its key subsidiaries' risk management practices. Climate-related risks are part of the company's overall risk management, integrated with other risk factors for control and monitoring.

Indicators and Targets

Risk Control Indicators

Based on the major climate risk matrix identified in 2023, the company has set control indicators for high-impact risks to ensure the risks remain within acceptable levels.

|

Risk Factor |

Indicator |

Response Action |

|

Infectious Diseases |

Investment management |

Conduct quarterly interviews with portfolio companies and compile a "Quarterly Investment Management Report" to track research and development progress without delays. |

|

Capital displacement |

Information transparency |

|

Emissions Statistics

In June 2024, the company will conduct its first greenhouse gas inventory for FY2023, including parent and subsidiary companies, aligning with the boundaries stated in the company's 2023 annual report. The inventory will follow the control approach outlined in ISO 14064-1:2018, incorporating emissions within the boundary while referencing SASB - Asset Management & Custody Activities standards to include portfolio companies emissions in the inventory scope.

-

Energy Consumption:

During 2023, energy usage included 2,574.170 liters of diesel for business vehicles and 123,243.416 kWh of electricity, resulting in a total energy usage of 148.326 MWh. -

Scope 1:

Including emissions from business vehicles and refrigerant leakage, calculated based on emission factors from Taiwan EPA's "Greenhouse Gas Emission Factor Management Table Version 6.0.4," resulting in emissions of 6.815 tCO2e.Unit:tCO2e

CO2

CH4

N2O

NF3

SF6

PFCs

HFCs

HFCs

Total

Scope1

6.708

0.010

0.010

0.000

0.000

0.000

0.000

0.000

6.815

- Scope 2:

Electricity consumption at the company's operational site totaled 123,243.416 kWh. Based on the Ministry of Economic Affairs' 2023 electricity emission factor of 0.494 kgCO2e/kWh, the carbon emissions from electricity consumption amounted to 60.882 tCO2e. -

Scope 3:

Including shared electricity consumption at office locations, business travel, and emissions from investments.Shared Electricity Consumption

Shared electricity consumption was 125,761.250 kWh, resulting in carbon emissions of 62.126 tCO2e.Business Travel

Including emissions from international flights and Taiwan High-Speed Rail, totaling 33.861 tCO2e.Investments

As an asset management company, the carbon footprint of our portfolio companies is the largest source of emissions. Therefore, we analyze and disclose the emissions of the portfolio companies according to the Sustainability Accounting Standards Board (SASB).We collect and disclose the Scope 1 and Scope 2 emissions of Diamond Biofund's porfolio companies based on the equity method. In 2023, using 4% of our investment cost as the materiality threshold, a total of five companies were included. The total disclosure rate, calculated based on the total book value of Diamond Biofund's "Financial Assets Measured at Fair Value through Profit or Loss - Current and Non-current," reached 77.02%.

To implement the carbon inventory plan for porfolio companies, we conducted multiple training sessions with the companies that met the threshold. These sessions not only helped the portfolio companies develop thinking around climate change adaptation but also guided them on how to conduct greenhouse gas inventories, enhancing the resilience of both Diamond Biofund and its portfolio companies in response to climate risks.

|

Method of Calculating Emissions for Portfolio Companies |

Equity Allocation Method Σ Shareholding Ratio * (Scope 1 + Scope 2 Emissions of the Company) |

|

Names of Portfolio Companies Included in the Calculation |

Oneness Biotech, Cho Pharma, StemCyte, Sinew Pharma, Tetanti |

|

Names of Investment Targets Included in the Calculation |

82.85% |

|

Proportion of Total Book Value Within Calculation Boundary |

77.02% |

|

Diamond Biofund Scope 3 – Investment Emissions |

269.705 tCO2e |

Climate-Related Goals

In June 2024, we will complete the first greenhouse gas inventory and verification for 2023 and will use SASB guidelines to include the emissions of portfolio companies within the Scope 3 disclosure.

With the company’s relocation to the Zhongxiao office in January 2024, and in alignment with ISO 14064-1 requirements for baseline establishment, we’ ve designated 2024 as the base year. Upon completing the emissions data compilation for 2024, the Board of Directors approved the carbon reduction targets (detailed in the table below) on December 23, 2024.

|

【Scope 1、2】Operation |

Adopt an absolute reduction method using 2024 as the base year, aiming to reduce Scope 1 and Scope 2 greenhouse gas (GHG) absolute emissions by 25% by 2030. |

|

【Scope 3】Investment |

the target is set using the "Engagement Approach." By 2030, 33% of the "book value of investment portfolios"(Note1) in diamond investments must either commit to or have established their own carbon reduction targets. |

Considering that the primary source of our emissions comes from Scope 3 investment of portfolio companies, we aim to continue expanding the company's influence by collaborating with portfolio companies to address climate change together. In addition to setting targets for Scope 1 and Scope 2 emissions within our own operations, we have also established Scope 3 investment-related goals. Through engagement and training initiatives, we seek to foster climate-conscious thinking among our portfolio companies, supporting them in developing emissions inventories and setting their own carbon reduction targets.